Deposit Status Endpoint

Retrieve the status of a previously created deposit

Deposit Status

Path Parameters

Name

Type

Description

Headers

Name

Type

Description

{

"user_id": "11",

"deposit_id": 300004285,

"invoice_id": "989409592",

"country": "BR",

"currency": "BRL",

"local_amount": 53162.00,

"usd_amount": 1000.00,

"bonus_amount": 1.50,

"bonus_relative": "false",

"payment_method": "VI",

"payment_type": "CREDIT_CARD",

"status": "COMPLETED",

"payer": {

"document": "17532655253",

"document_type": "CPF",

"email": "[email protected]",

"first_name": "John",

"last_name": "Smith",

"address": {

"city": "Sao Paulo",

"state": "SP",

"street": "John Street 2453",

"zip_code": "938475-234"

}

},

"fee_amount": 2.50,

"fee_currency": "USD",

"bank_account": {

"account_number": "10122538",

"bank_branch": "90",

"ispb_code": 60746948,

"bank_name": "Caixa",

"account_type": "SAVING",

"licensed_bank": true

},

"card_detail": {

"card_holder": "John Smith",

"brand": "Visa",

"masked_card": "1234 56** **** 6789",

"expiration": "2023-12",

"card_type": "DEBIT",

"transaction_result": "Transaction Approved"

}

}Request

Example request

Example response

Response fields

Parameter current_payer_verification

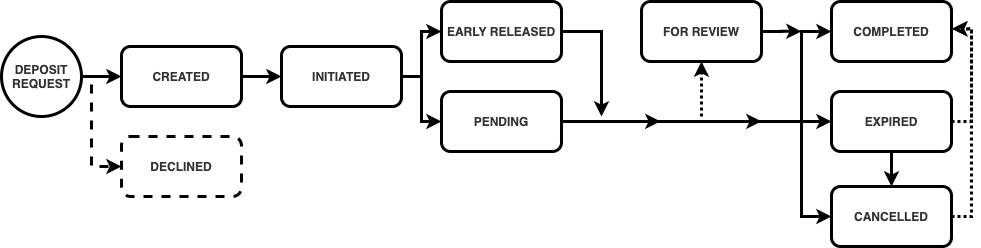

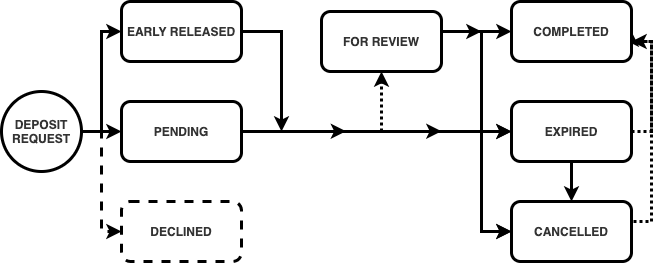

Status Flow

Hosted Checkout Status Flow

OneShot Checkout Status Flow

Status codes

API CodesLast updated

Was this helpful?